Are the days of customization hell and vendor lock-in finally over?

Using standard software to support business process management and control in midsized companies started with the invention of the minicomputer in the late 1970s and got its breakthrough with the IBM-compatible PC platform in the late 1980s. By the mid-1990s Gartner grouped such software together under the term Enterprise Resource Planning, or ERP.

In the same period two Danish companies, Damgaard Data and Navision Software pioneered ERP products with SDKs (Software Development Kit) that allowed individual customization, which again expanded the footprint of PC-based solutions to even more and bigger companies.

With the rapid proliferation of the Internet and the steady improvement in the price/performance of hardware, the idea of offering software and computer capacity "as-a-service" entered the hype cycle in 2000 and has gradually matured since then.

Cloud computing and SaaS, as it has now been named, are especially attractive to mid-sized companies as they can convert CAPEX (Capital expenditure) to OPEX (Operational expenditure), but also because they can enjoy the advantages of not having to have an internal IT department taking care of systems management and support.

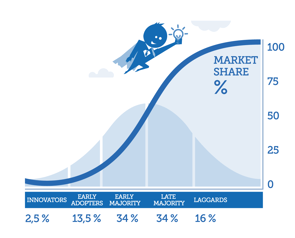

However, the adoption rate of cloud computing and SaaS has been much slower than the IT industry expected. The Law of Diffusion of Innovation has played its usual role, but three other issues have been holding companies back from this digital transformation.

1. Migration cost and risk

Moving from an on-premise to a cloud-based ERP platform is a full blow migration project. Few companies will be motivated to do so unless there is a compelling reason and substantial benefit. Otherwise, the business case will not show black numbers over a reasonable period. ERP systems seem to run until external circumstances bring them to a halt.

Learn why JST was motivated to take the leap with RamBase Cloud ERP

2. The legacy liability and debt

While the possibility for customization reduced the cost of developing ERP systems, for many companies it also introduced legacy liability and debt. Upgrading customized applications with new versions of the underlying software components became expensive without offering any tangible value. Therefore, many companies didn’t do it. Cloud-based ERP systems offered on a SaaS basis tend to be much more standardized and mapping a migration path from the past to the future is perceived as a major undertaking.

3. Implementation partners

On-premise ERP solutions offer an attractive professional services revenue stream for the suppliers. Often the tie to the implementation partner is particularly strong because of the in-depth knowledge of the customizations made. Cloud-based ERP systems are expected to be less expensive to implement and support, which makes the immediate suppliers reluctant to push the customers towards a SaaS migration project.

The market opportunity

Although one would consider the ERP market fairly mature and saturated, the shift from on-premise customized solutions to SaaS and cloud-based standard solutions has opened the market for insurgents. Vendors with no installed base to protect and a clean technology sheet are currently moving in and taking market share from the incumbents.

Norwegian RamBase Cloud ERP is such an insurgent. Starting out as an internal development project for Hatteland in 1992, RamBase was spun-off as an independent ERP brand in 2016. RamBase is expanding globally, with outperformed market growth in 2018 (41%) and expect to more than double the growth rate in 2019.

Value Proposition

RamBase is a complete ERP system offered exclusively in a SaaS format. The primary competitive edges are completeness and possibilities for fast implementation (mostly in less than eight weeks). Country-specific localization is done by RamBase in Norway based on specifications provided by chartered accountants and market analysts in each country.

“You could claim that we are just another ERP system,” says Odd Magne Vea, CSO with Rambase. “However, the change from perpetual on-premise to SaaS in the cloud does open up the market completely. Where the established vendors seem to be adding more and more peripheral applications to their platforms, we have taken the opposite route. We offer core ERP functionality that can be implemented fast. When the core functions are in place then we can work with the customers to expand the functionality, but we have no ambition of covering all the peripheral application areas for which there are plenty of great products available already”.

Simplification seems to be an attractive value proposition for those customers that have experienced the customization trap and have paid the associated premium.

“Our technology with continuous releases and microservices is still ahead of many competitors”, stresses Odd Magne Vea. “Our platform and SDK will be increasingly important to help partners make money on integrations, apps, and modifications. It’s not so different from the product direction that, especially, Microsoft is taking. However, many partners and customers prefer a more intimate relationship with their suppliers and that’s what we can offer.”

The market segmentation

The main market focus for RamBase is discrete manufacturing and distribution companies in Norway, Sweden, The UK and Poland. The company is open to entering additional countries but has made no priority list yet. Market entrance is highly dependent on the quality of people they can find and where their current customers may have a need for local support.

“With RamBase our customers get support for their complex processes and sophisticated functional needs, delivered as a standard cloud-based service,” says Odd Magne Vea. “We support really complex manufacturing processes including the need for detailed traceability, quality control and documentation. Before, this was only achievable through on-premise installations with lots of customization. Not anymore. Our customers get an “out of the box” standard SaaS solution. Our competitors may claim that complex needs still require “on-premise” or managed solutions, but that is not the case. The days of customization hell and vendor lock-in are finally over.”

The Channel

RamBase has chosen a clean indirect go-to-market approach where implementation partners are responsible for the entire revenue generation process. The first partners in each country receive substantial support from RamBase including co-funding of the entire revenue generation process.

“The competitive situation differs from country to country,” explains Odd Magne Vea, “but as far as we can see there are opportunities everywhere. Apart from Sweden, Poland and the UK, where we are currently making heavy investments, the sequence for when to enter which country is very much dependent on the people we can find. It takes an entrepreneurial mindset to start up a country operation and there are only so many people for which the task and the timing is right.”

When entering a new country RamBase engages a local business development manager to recruit the business and implementation partners and to work closely with them to win the first deals. The cooperation works like a joint venture where the objective is to create a first bridgehead for the product.

“The partners that help us get established in a new country will obviously enjoy co-investments and dedicated support,” Odd Magne Vea continues. “We understand that our partners are breaking the ice for us and we will help them protect their investments and commitment. Building an ERP-reseller channel has been done before and we have learned what it takes to grow the business and keep partners happy at the same time.”

Key resources and activities

The RamBase challenges are revenue generation and customer success. Maintaining a complete ERP system is not considered the prime challenge at RamBase. They have been working in this domain for 25 years and have more standard functionality than their closest competitors. The main challenges are revenue generation and customer success.

“We realize that, from a functionality perspective, we are operating in a very mature market,” admits Odd Magne Vea. “Nevertheless, as soon as potential customers learn about our technology and value proposition the probability of winning a project is high. Our primary challenge is recruiting more partners, that can talk to more customers and build up the support capacity to keep them both happy. We have the technology, now we need to build the marketing and customer success muscle.”

Hans Peter Bech M.Sc. (econ.)

tbkconsult.com