Although the IT industry is hardly fifty years old, it has already seen massive disruption and has been the playground for spectacular ups and downs. Do you recall names such as Control Data, Digital Equipment Corporation, Compaq, 3Comm, Novell, Netscape, WordPerfect, Lotus 123, Sybase, Invensys and Baan?

They are all brands that enjoyed worldwide recognition and large market shares yet became victims of rapid technological changes and customer preferences. Some were acquired and disappeared into the dust of a merger while others closed shop.

Are we approaching yet another inflection point in the IT industry? In Åmsosen, a small village in the Norwegian Westland between Stavanger and Bergen, they are convinced that the time is ripe for a major shift in one of the largest software markets: ERP.

Here are the reasons why.

The lessons that history can teach us

If you take a closer look at the changes in the IT industry, you will see a clear pattern revealing itself.

The major changes are caused by shifts in technology. However, it is not the technology per se that drives the changes, but the new applications and especially the attractive price/performance ratios that it enables. The outcomes are products that can do more, are easier to use and cost less. This simple formula attracts the broadest market appeal and will rapidly mature, concur with early innovators and move into the mainstream segments.

The personal computer, introduced by Apple and made an industry standard by IBM, literally killed the mainframe and minicomputer industry. Combined with emerging LAN technology, it became the platform for thousands of small software houses that developed applications enabling small and medium-sized companies to use IT for more and more business processes.

With the introduction of Microsoft Windows in the mid-1990s, computers became more user-friendly and moved into people’s homes.

The internet changed everything, but it wasn’t until Netscape made it accessible through their Mosaic browser that the proliferation took off. Microsoft embedded Internet Explorer in Windows, killing Netscape and fuelling the explosion. Today, the internet has 4.5 billion users.

The ERP market is turning 30 in 2020

Gartner coined the term ERP in 1990 to describe the software category that supports a company’s internal business processes. With the expansion of the internet, the term ERP II was introduced to include external business processes as well.

Read why Rambase earns honourable mentions in the 2021 Gartner Magic Quadrant

By the millennium ERP had become one of the biggest IT markets motivating Microsoft to acquire Great Plains Software and Navision.

The growth of the ERP market was stimulated by the combination of rapidly falling hardware prices (PCs in a LAN) and software, allowing customers to adapt the functionality to meet their specific requirements. Many companies migrated from a proprietary minicomputer-based solution to take advantage of the open PC platform, ending up in a new set of chains.

Today industry analysts estimate the global market for ERP software to be around USD 40 billion and growing at a rate of ten per cent annually, even when the delivery format is changing from pre-paid licenses to ongoing subscriptions.

The Internet, Cloud, SaaS and Best-of-Breed

The technology wheel is yet again making a significant turn. It started around 2000 and was named ASP – Applications Service Provider. Later it changed its name to Software-as-a-Service and was further fuelled by the introduction of the cloud computing delivery format spearheaded by the launch of Amazon Web Services in 2002.

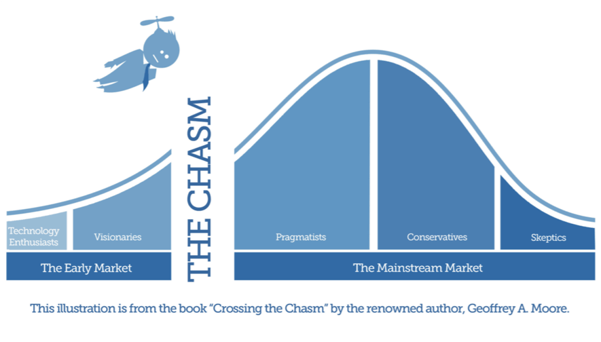

Today, twenty years into its maturity cycle, more than four out of ten new ERP systems run in the cloud and in a few years, cloud-based solutions will outnumber their on-premise cousins. Public cloud-based ERP delivered in the SaaS format has jumped the chasm and is rapidly making it through to the mainstream markets. The barriers to market entry for new software companies have been lowered even further, and the supply of all types of solutions is increasing every single day.

Small and medium-sized enterprises have fast accepted the cloud-based best-of-breed solution architecture. It supplies support for their essential business processes with attractive cost-of-ownership and moderate customization and implementation effort. They can do more at a lower cost and with a shorter learning curve. Precisely that combination remains the success formula in the software industry.

Fit for purpose

In the midst of these global technology and business model changes, we find RamBase rising from the green-grey mountains of West Norway.

In my recent post about my first meeting with RamBase, I explained why that should not come as a big surprise to anyone. As software becomes available through the browser and takes more standardized formats, we will see increased globalization of the software industry. Silicon Valley may remain the epicentre of consumer-directed blockbusters, but in the future, business software will come from all corners of the world. When the ERP industry was born, all the vendors had a clause in their license agreement emphasizing that they could not warrant that the software was fit-for-purpose. It was a somewhat peculiar phrase: “Here is the software – it may not do what you want it to do.”

The reason for the clause was that the ERP vendors wanted to sell their software to as many types of companies as possible and that they had resellers that lived from customizing it. For each dollar of software sold the resellers sold nine dollars of services. That business model generated handsome profits for the vendors and their business partners, but often at the expense of their customers.

“We are convinced that the primary reason for the popularity of the cloud-based best-of-breed architecture can be found in its attractive price/performance,” says Odd Magne Vea, CSO at RamBase. “The big cost reductions are to be found in the customization, implementation and upgrade portions of the projects because that’s where the money went.”

The RamBase channel

This philosophy has had a major impact on how RamBase perceives the role of its business partners.

“We also rely on business partners to help our customers implement RamBase,” says Odd Magne Vea, “but we want them to be systems integrators and ISVs, as opposed to traditional VARs.”

Where the traditional VAR (Value-Added Resellers) primarily is a consulting company selling hours to each customer, an ISV (Independent Software Vendor) will develop extensions to RamBase and sell these to a range of customers. Using the same software across many customers can lower the initial price per customer. Still, the cost of updating and upgrading the software is also spread over more users.

Systems integration is required to tie together IT solutions that support business processes and offer facilities not covered by the core ERP system, such as webshops, business intelligence, mobile apps and automation equipment.

“RamBase does offer a different value proposition,” says Jakub Polkowski, Partner Channel Executive for RamBase in Poland. “It is not only an ERP system, it’s also an ERP platform. The technology opens up a whole new world of possibilities for our resellers. They can now become software companies in their own right as opposed to just local consulting shops.”

The customer value proposition

All the thinking and analysis laid out above only make sense if the customers agree. It seems as if they do.

AutoStore, a company developing warehouse robots and systems, went live with RamBase in 2012. They have experienced the benefits of having a system that is tailored for companies working with engineer-to-order manufacturing.

“Last year, we produced 4,000 robots, more than 20 times more than in 2012. With over one thousand parts in a single product, such growth is only possible with our RamBase ERP system” said Adam Sidorowicz, Improvement & Special Project Manager, AutoStore Poland.

AutoStore is operating in probably the most expensive business environment as with other Norwegian enterprises. Productivity improvement is always the number one item on the agenda.

“The combination of our unique technology and our ability to get customer deliveries right first time is our secret sauce,” says Helge Olsen, AutoStore CSO. “We are growing rapidly and must be certain that we can deliver on our commitments. RamBase gives us the transparency to do that.”

Invented in Norway and disrupting the warehouse systems industry, AutoStore currently operates in US, UK, Germany, France, Poland and Japan. Further international expansion is on the table.

“We are extending our operation to cover more international markets”, says Karl Johan Lier, AutoStore CEO and president, “With RamBase we can start a new subsidiary just by duplicating what we have done in other countries. All we need is a decent internet connection and then we are in business.”

Hans Peter Bech M.Sc. (econ.)

tbkconsult.com